Understanding Gold IRA Company Ratings: A Complete Case Study

페이지 정보

작성자 Vaughn 작성일25-08-29 18:54 조회9회 댓글0건관련링크

본문

In recent times, the appeal of investing in gold has surged, notably by means of Particular person Retirement Accounts (IRAs). Gold IRAs supply investors a way to hedge towards inflation and economic uncertainty, making them a preferred alternative for retirement planning. Nonetheless, with the proliferation of gold IRA companies, it becomes crucial for buyers to understand how to evaluate these corporations effectively. This case examine explores the rankings of various gold IRA companies, highlighting key factors that contribute to their reputations and reliability.

The Rise of Gold IRAs

Gold IRAs permit traders to hold physical gold and different precious metals as a part of their retirement portfolio. In contrast to conventional IRAs, which typically include stocks, bonds, and mutual funds, gold IRAs provide a tangible asset that may act as a safeguard in opposition to market volatility. As the economic system fluctuates and inflation rises, many individuals are turning to gold as a stable investment option.

Significance of Gold IRA Company Ratings

With numerous companies providing gold IRA companies, it is important for investors to evaluate the credibility and performance of these firms. Firm ratings serve as a guide for potential investors, serving to them make informed decisions. Rankings are often derived from customer opinions, trade analysis, regulatory compliance, and financial stability. Understanding these ratings can assist traders in choosing a reliable firm to manage their gold IRA.

Key Factors Influencing Rankings

- Customer Opinions and Testimonials: One of many most vital factors influencing a gold IRA company's rating is buyer suggestions. Prospective investors usually search for companies with optimistic opinions that reflect excellent customer support, transparency, and reliability. Platforms akin to TrustPilot, Higher Business Bureau (BBB), and Client Affairs provide a wealth of knowledge on customer experiences.

- Industry Popularity: The status of a gold IRA company within the business can also influence its rankings. Corporations which have been in the business for several years and have established a solid track record are generally viewed more favorably. Industry awards, recognitions, and partnerships with reputable organizations can enhance an organization's standing.

- Regulatory Compliance: Compliance with government regulations is critical for any financial establishment, including gold IRA companies. Companies that adhere to IRS guidelines for precious metals in retirement accounts are more likely to receive favorable ratings. Traders should verify that the corporate holds the mandatory licenses and adheres to trade requirements.

- Fees and Costs: The charge structure of a gold IRA company plays a big position in its rankings. Investors are suggested to match charges related to account setup, storage, and administration. Corporations that supply transparent pricing and competitive charges are inclined to receive higher rankings, as hidden charges can result in dissatisfaction amongst clients.

- Academic Assets: Firms that provide educational resources to assist purchasers perceive the complexities of gold ira companies complaints (https://Masaken-Ae.com/) investing usually receive larger ratings. Traders respect companies that empower them with information about market traits, funding methods, and the benefits of gold IRAs.

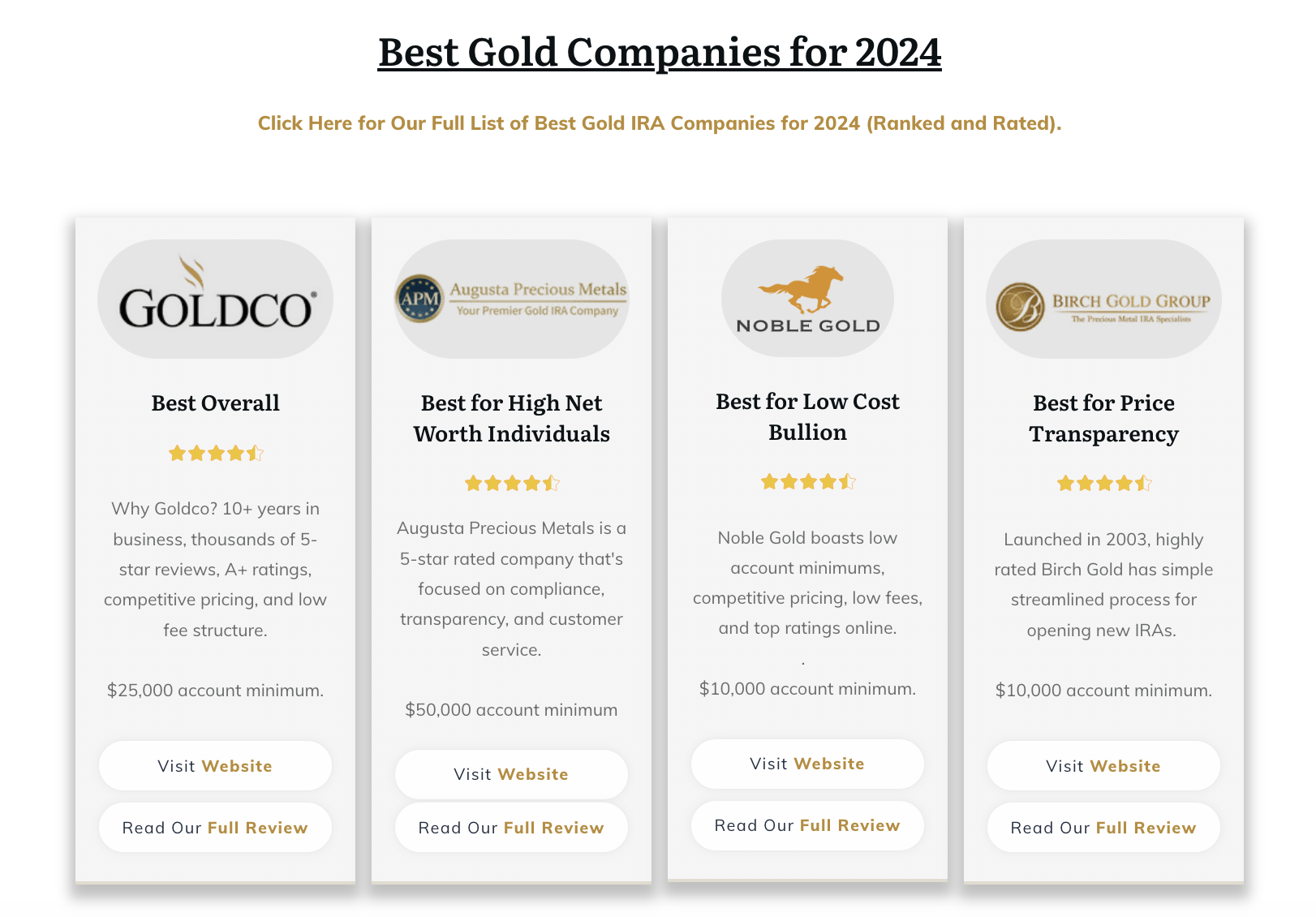

Case Study: Comparing Gold IRA Companies

For instance the significance of scores, we'll examine three outstanding gold IRA companies: Goldco, Augusta Valuable Metals, and Birch Gold Group. Every company has its distinctive strengths and weaknesses, that are mirrored in their scores.

Goldco

Goldco is a properly-established gold IRA company that has garnered a robust status in the industry. With an A+ rating from the BBB and numerous optimistic customer opinions, Goldco is often really useful for its distinctive customer service and academic assets. The corporate gives a easy price structure and provides clients with access to a wide range of valuable metals. Goldco's dedication to transparency and buyer satisfaction has earned it a excessive ranking amongst traders.

Augusta Treasured Metals

Augusta Treasured Metals is another main player in the gold IRA market. It boasts an impressive array of educational supplies, including webinars and one-on-one consultations, which help investors make knowledgeable selections. Augusta has obtained excessive rankings for its customer service and has an A+ score from the BBB. The company's transparent charge structure and focus on lengthy-time period relationships with clients contribute to its favorable ratings.

Birch Gold Group

Birch Gold Group is thought for its extensive expertise in the treasured metals business. The corporate has a stable fame, with a B+ rating from the BBB. Whereas Birch Gold Group gives a variety of investment options and educational sources, some customer evaluations highlight concerns about response occasions and communication. Nevertheless, the company's commitment to compliance and transparency helps maintain its credibility available in the market.

Conclusion

In the evolving panorama of gold IRA investing, understanding company scores is important for making knowledgeable selections. As demonstrated in this case examine, components corresponding to customer comprehensive reviews of the best gold ira companies, business repute, regulatory compliance, charge constructions, and academic resources significantly affect the rankings of gold IRA companies. Investors must conduct thorough research and consider these factors when selecting a company to manage their gold IRA.

Finally, a effectively-rated gold IRA company can present peace of thoughts, ensuring that investors' retirement financial savings are in capable arms. By prioritizing transparency, customer service, and regulatory compliance, gold IRA companies can build belief and credibility, paving the best way for long-time period success within the precious metals market. As the demand for gold IRAs continues to develop, understanding these ratings will remain essential for traders seeking to secure their financial future.

댓글목록

등록된 댓글이 없습니다.