Complete Study Report on Physical Gold For Sale

페이지 정보

작성자 Ilene Cordova 작성일25-08-14 02:02 조회6회 댓글0건관련링크

본문

Introduction

Gold has been a logo of wealth and a retailer of value for centuries. Its bodily form, whether in bars, coins, or jewelry, continues to attract traders and collectors alike. This report supplies an in depth analysis of physical gold for sale, exploring its market dynamics, sorts, advantages, dangers, and the present developments affecting its worth.

The Marketplace for Bodily Gold

The marketplace for physical gold is influenced by various elements, together with economic situations, geopolitical tensions, and changes in currency values. Gold is commonly seen as a safe-haven asset, notably during times of economic uncertainty. If you have any queries regarding exactly where and how to use purchase online gold, you can call us at our own page. The worldwide gold market is huge, with vital players together with central banks, institutional investors, and individual patrons. Key markets for bodily gold include the United States, Europe, India, purchase online gold and China, the place cultural significance and investment demand drive sales.

Sorts of Bodily Gold Out there

- Gold Bars: Gold bars are a preferred form of bodily gold investment. They come in numerous sizes, usually ranging from one ounce to a number of kilograms. The larger the bar, the decrease the premium over the spot worth of gold. Buyers typically favor gold bars for his or her purity and decrease premiums.

- Gold Coins: Gold coins are minted by governments and are sometimes considered legal tender. Widespread examples include the American Gold Eagle, Canadian Gold Maple Leaf, and South African Krugerrand. Coins sometimes carry a better premium than bars due to their numismatic value and recognition.

- Gold Jewellery: While not primarily an funding vehicle, gold jewelry is a major part of the bodily gold market. In international locations like India, gold jewelry is commonly bought for cultural causes and as a type of financial savings. The price of gold jewellery reflects both the market worth of gold and the craftsmanship involved.

- Gold ETFs: Although not physical gold, Gold Alternate-Traded Funds (ETFs) enable buyers to gain exposure to gold with out holding the physical steel. These funds usually hold physical gold in vaults and issue shares that characterize ownership in the gold held by the fund.

Advantages of Investing in Bodily Gold

Investing in bodily gold provides a number of advantages, including:

- Tangible Asset: Not like stocks or bonds, bodily gold is a tangible asset that may be held and stored. This characteristic supplies a sense of security for many traders.

- Hedge Against Inflation: Gold has historically been viewed as a hedge in opposition to inflation. When the buying power of fiat currencies declines, gold usually retains its worth.

- Portfolio Diversification: Including physical gold in an investment portfolio may help diversify danger. Gold typically has a low correlation with other asset courses, making it a worthwhile addition during market volatility.

- Global Acceptance: Gold is universally recognized and accepted, making it a liquid asset that can be simply purchased and sold across the globe.

Dangers of Investing in Physical Gold

Regardless of its advantages, investing in bodily gold comes with sure dangers:

- Storage and Safety: Bodily gold requires safe storage, which can incur further prices. Investors should consider the dangers of theft and injury.

- Market Volatility: The value of gold can be unstable, influenced by elements comparable to interest charges, foreign money fluctuations, and geopolitical occasions. Traders could experience vital worth swings.

- Lack of Earnings: Unlike stocks or bonds, physical gold does not generate earnings or dividends. Traders rely solely on value appreciation for returns.

- Premiums and Fees: Purchasing bodily gold often involves paying premiums over the spot worth, which might fluctuate based mostly on the kind and type of gold. Additionally, selling gold could incur transaction charges.

Present Trends in the Gold Market

As of 2023, several trends are shaping the physical gold market:

- Elevated Demand Amid Economic Uncertainty: Ongoing geopolitical tensions and economic challenges, corresponding to rising inflation and curiosity charges, have led to increased demand for physical gold as a secure-haven asset.

- Sustainable Gold Mining Practices: There is a rising emphasis on sustainability inside the gold mining business. Buyers are increasingly in search of ethically sourced gold, resulting in a rise in demand for responsibly mined gold products.

- Digital Gold: The emergence of digital platforms providing gold-backed tokens and on-line gold purchasing has made it simpler for traders to buy and promote physical gold. This pattern is attracting a youthful demographic serious about gold funding.

- Central Bank Purchases: Central banks all over the world have been growing their gold reserves as a hedge against currency fluctuations and financial instability. This trend helps gold prices and reflects a broader institutional interest in gold.

How you can Buy Physical Gold

Buyers all for purchasing physical gold can consider the next options:

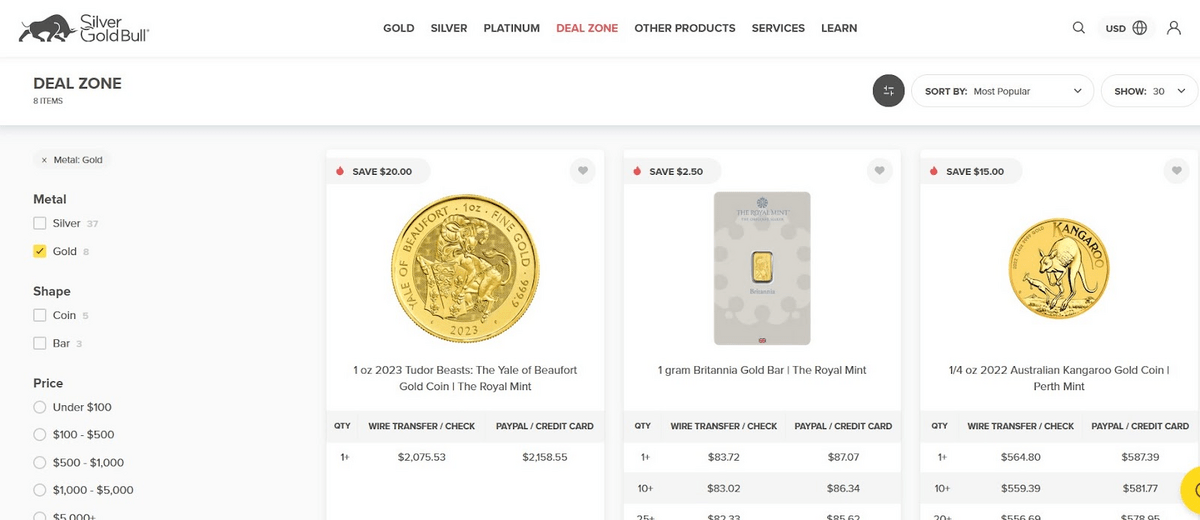

- Authorized Dealers: Shopping for from reputable sellers ensures the authenticity and high quality of the gold. Traders should look for sellers with good critiques and clear pricing.

- On-line Platforms: Many online platforms offer the comfort of buying gold from the consolation of residence. It's essential to verify the credibility of the platform and perceive the phrases of sale.

- Auctions and Property Gross sales: Traders might discover distinctive gold items at auctions or property gross sales. Nevertheless, thorough research and valuation are crucial to ensure truthful pricing.

Conclusion

Bodily gold remains a invaluable asset for investors searching for security, diversification, and a hedge towards financial uncertainty. Whereas the market presents varied types of gold, including bars, coins, and jewelry, potential investors must weigh the advantages towards the risks related to physical possession. Current tendencies point out a strong demand for gold, pushed by economic elements and purchase online gold evolving consumer preferences. Because the market continues to evolve, understanding the dynamics of physical gold for sale will likely be essential for informed funding choices.

댓글목록

등록된 댓글이 없습니다.