Gold IRA Investment: A Comprehensive Guide

페이지 정보

작성자 Booker 작성일25-08-06 00:02 조회5회 댓글0건관련링크

본문

Introduction

Lately, the allure of gold as an investment has regained prominence, significantly within the context of retirement savings. With financial uncertainties and fluctuating markets, many traders are turning to Gold Particular person Retirement Accounts (IRAs) as a strategic method to diversify their portfolios and protect their wealth. This report aims to supply a detailed overview of Gold IRA investments, together with their benefits, dangers, and the process of setting one up.

What's a Gold IRA?

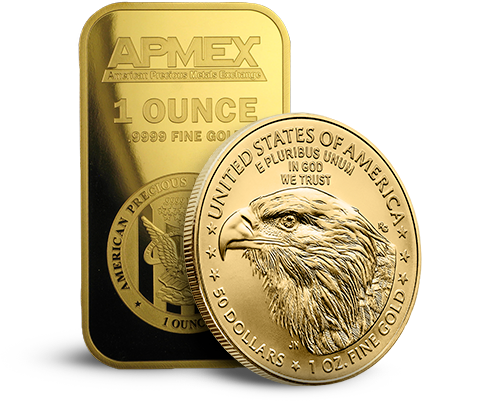

A Gold IRA is a sort of self-directed Particular person Retirement Account that allows buyers to carry physical gold, as well as other valuable metals, as part of their retirement portfolio. In contrast to conventional IRAs, which typically embrace stocks, bonds, and mutual funds, a Gold IRA offers the opportunity to invest in tangible assets. This can include gold bars, coins, and bullion, which should meet specific purity requirements set by the inner Revenue Service (IRS).

Advantages of Gold IRA Investment

- Hedge Against Inflation: One of the primary reasons traders turn to gold is its historical ability to act as a hedge in opposition to inflation. Throughout times of economic downturn or inflationary stress, gold tends to retain its worth, making it a horny choice for preserving wealth.

- Portfolio Diversification: Including gold in an funding portfolio can present diversification, reducing general threat. Gold often behaves in a different way from stocks and bonds, which can assist stabilize returns throughout market volatility.

- Tax Advantages: Gold IRAs provide the identical tax benefits as traditional IRAs. Contributions may be tax-deductible, and funding development is tax-deferred till withdrawals are made during retirement. Additionally, qualified distributions are taxed at extraordinary income rates, which might be advantageous for retirees in decrease tax brackets.

- Tangible Asset: In contrast to paper assets, gold is a bodily commodity that traders can hold. This tangibility can provide peace of thoughts, especially during economic uncertainty when paper belongings could also be more risky.

- World Demand: Gold has a common appeal and demand, pushed by its use in jewelry, expertise, and as a reserve asset for central banks. This world demand can help sustain its worth over time.

Dangers of Gold IRA Investment

- Market Volatility: While gold is commonly seen as a safe haven, its price can nonetheless be subject to significant fluctuations primarily based on market circumstances, geopolitical events, and modifications in demand.

- Storage and Insurance coverage Costs: Holding bodily gold requires safe storage, which can contain additional costs. Buyers should consider the bills related to vaulting providers and insurance coverage to guard their belongings.

- Limited Growth Potential: Not like stocks, which have the potential for capital appreciation by way of company progress, gold does not generate income or dividends. Its worth is primarily driven by market demand and provide.

- Regulatory Compliance: Gold IRAs should comply with IRS rules, which may complicate the funding course of. Buyers want to pay attention to the foundations governing the sorts of gold that may be held and the custodians that can be utilized.

Setting up a Gold IRA

Establishing a Gold IRA includes several steps:

- Select a Custodian: The first step is to select an IRS-authorized custodian who focuses on treasured metals. The custodian will handle the account and ensure compliance with IRS regulations.

- Open the Account: As soon as a custodian is chosen, buyers can open a self-directed Gold IRA. This process sometimes entails filling out an application and offering essential documentation.

- Fund the Account: Traders can fund their Gold IRA through various methods, including direct contributions, rollovers from existing retirement accounts, or transfers from different IRAs. It’s essential to comply with IRS pointers during this process to avoid penalties.

- Select Treasured Metals: After funding the account, traders can choose the kinds of gold and different treasured metals they wish to buy. The IRS has specific necessities for the purity and sorts of metals that can be held in a Gold IRA.

- Purchase and Storage: The custodian will facilitate the acquisition of the chosen metals and arrange for their safe storage in an approved facility. If you loved this post and you wish to receive details relating to secure retirement with gold-backed iras assure visit our own website. Investors cannot take bodily possession of the metals until they attain retirement age, as this is able to violate IRS rules.

Varieties of Precious Metals in a Gold IRA

While gold is the first focus of a Gold IRA, investors also can embrace other treasured metals, similar to:

- Silver: Usually seen as a extra inexpensive alternative to gold, silver may function a hedge towards inflation and a technique of portfolio diversification.

- Platinum: This uncommon metallic has industrial purposes and may present a unique funding alternative inside a Gold IRA.

- Palladium: Similar to platinum, palladium has both industrial and funding enchantment, making it a precious addition to a diversified valuable metals portfolio.

Conclusion

Investing in a Gold IRA can be a strategic move for those seeking to diversify their retirement portfolios and protect their wealth from financial uncertainties. Whereas there are numerous benefits to this funding approach, together with inflation hedging and portfolio diversification, it is important to be aware of the related risks and prices. By understanding the means of establishing a Gold IRA and secure retirement with gold-backed iras the kinds of treasured metals out there, traders can make knowledgeable selections that align with their lengthy-time period financial objectives. As with any investment, consulting with a monetary advisor is recommended to make sure that a Gold IRA matches inside a person's general retirement technique.

댓글목록

등록된 댓글이 없습니다.