No Credit Score Check Loans: A Lifeline for a Lot Of Borrowers

페이지 정보

작성자 Niklas Hanger 작성일25-07-23 21:01 조회5회 댓글0건관련링크

본문

In an era where monetary stability is paramount, many people discover themselves trapped in a cycle of debt and poor credit score historical past. Conventional lending practices usually exclude these with low or nonexistent credit score scores, leaving them with restricted choices. Nonetheless, the emergence of no credit score check loans is altering the lending panorama, providing a lifeline for borrowers who may have been sidelined by conventional banks.

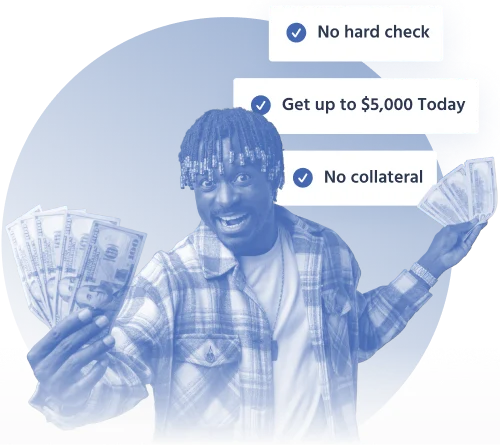

No credit score check loans are designed particularly for people who might have poor no credit Score Check loans credit histories or who have never had the chance to build a credit score rating. These loans are usually offered by various lenders, credit unions, and peer-to-peer lending platforms, which have become increasingly well-liked lately. The first appeal of those loans lies of their accessibility; they permit borrowers to obtain funds without undergoing the rigorous credit score checks that traditional lenders require.

For a lot of, the need for a loan can arise from unexpected expenses corresponding to medical payments, automobile repairs, or emergency dwelling repairs. In these conditions, accessing fast cash could be essential. No credit score check loans can provide that rapid relief. Borrowers can typically obtain funds within 24 hours, making them a viable choice for these dealing with urgent monetary wants.

Nonetheless, while the advantages of these loans are obvious, they come with their own set of challenges and risks. One of many most significant drawbacks is the upper curiosity charges associated with no credit score check loans. Lenders who offer these loans typically cost greater charges to offset the chance of lending to individuals with poor credit score histories. Because of this, borrowers may discover themselves in a cycle of debt if they are unable to repay the loan promptly.

One other concern is the potential for no credit score check loans predatory lending practices. Some lenders might take advantage of borrowers' desperation by providing loans with exorbitant charges or unfavorable terms. It is essential for people considering no credit score check loans to conduct thorough analysis and understand the entire value of borrowing earlier than committing to any agreement. Studying the effective print and guaranteeing that the lender is respected will help mitigate the risk of falling sufferer to predatory practices.

Regardless of these challenges, no credit score check loans could be a useful software for many who need fast financial assistance. For people who're working to rebuild their credit, these loans can serve as a stepping stone. By making well timed funds, borrowers can reveal their reliability and doubtlessly enhance their credit score scores over time. Some lenders even report borrowers' cost history to credit bureaus, allowing them to build a positive credit profile.

It's also price noting that no credit score check loans usually are not restricted to personal loans. Many companies are also turning to a lot of these loans to secure funding with out the stringent necessities sometimes related to conventional enterprise loans. Entrepreneurs with limited credit score histories can entry the capital they should grow their businesses, hire workers, and invest in new opportunities.

Because the demand for no credit score check loans continues to rise, it is essential for borrowers to stay knowledgeable about their options. On-line marketplaces and financial technology firms are making it simpler than ever to check loan affords and discover the very best terms. Borrowers should take benefit of these sources to make sure they are getting probably the most favorable deal potential.

For those considering a no credit score check loan, it is crucial to judge their monetary situation carefully. Borrowers ought to assess their capacity to repay the loan and consider whether or not they have other options obtainable to them. For instance, neighborhood help packages, personal financial savings, or loans from family and friends may present different options that don't include high-interest charges or fees.

In conclusion, no credit score check loans characterize a major shift within the lending panorama, providing a viable solution for people who could have been neglected by conventional banks. While these loans can provide quick access to money and assist borrowers rebuild their credit, additionally they come with risks that have to be carefully weighed. As the monetary world continues to evolve, it is essential for borrowers to remain informed and make educated choices about their financial futures. By understanding the benefits and drawbacks of no credit score check loans, individuals can navigate their financial challenges extra successfully and work in direction of attaining greater monetary stability.

댓글목록

등록된 댓글이 없습니다.