The Complete Guide to Gold IRA Kits: Safeguarding Your Retirement With…

페이지 정보

작성자 Quentin 작성일25-07-23 19:27 조회6회 댓글0건관련링크

본문

In an period where monetary markets are more and more volatile and economic uncertainties loom massive, many buyers are looking for alternative methods to safeguard their retirement savings. One such technique gaining popularity is the Gold Individual Retirement Account (IRA). A Gold IRA permits individuals to put money into bodily gold and other treasured metals as a means of diversifying their retirement portfolios. This article delves into the important components of a Gold IRA kit, its advantages, and concerns for potential traders.

Understanding Gold IRAs

A Gold IRA is a self-directed retirement account that enables investors to hold physical gold, silver, platinum, and palladium. Unlike conventional IRAs that typically hold paper belongings like stocks and bonds, Gold IRAs offer the unique benefit of tangible belongings that may provide a hedge against inflation and financial downturns. The interior Income Service (IRS) regulates these accounts, stipulating specific necessities for the kinds of metals that may be included, their purity, and storage methods.

The Parts of a Gold IRA Kit

A Gold IRA kit typically contains several key parts that investors should remember of:

- Custodian Companies: A custodian is a financial institution chargeable for managing the Gold IRA. They handle the purchase, storage, and sale of the treasured metals. It is crucial to choose a reputable custodian with experience in dealing with Gold IRAs, as they must adjust to IRS laws.

- Storage Solutions: Gold IRAs require secure storage for the bodily metals. If you are you looking for more info regarding bestmusics.godohosting.com stop by the internet site. Investors can select between segregated storage, the place their property are saved separately from others, or commingled storage, where metals from multiple buyers are saved together. Many custodians associate with IRS-accepted depositories to make sure the safety of the belongings.

- Gold IRA Rollover Instructions: For these looking to transfer funds from an current retirement account, the Gold IRA kit ought to provide clear instructions on tips on how to perform a rollover. This course of includes shifting assets from a conventional IRA or 401(ok) right into a Gold IRA without incurring tax penalties.

- Investment Options: A complete Gold IRA kit will outline the types of treasured metals that may be included in the account. The IRS mandates that gold should have a minimum purity of 99.5%, whereas silver have to be no less than 99.9%. Widespread choices embrace American Eagle coins, reliable investment options with gold Canadian Maple Leaf coins, and gold bars from permitted refiners.

- Academic Resources: A top quality Gold IRA kit often includes educational materials that help buyers understand the advantages and dangers associated with investing in treasured metals. This will likely embody market evaluation, historical performance information, and insights into how gold can match right into a diversified investment strategy.

Advantages of Investing in a Gold IRA

Investing in a Gold IRA gives several benefits that make it a sexy possibility for retirement planning:

- Hedge In opposition to Inflation: Gold has traditionally maintained its value over time, making it an efficient hedge in opposition to inflation. As the cost of residing rises, the buying power of fiat currencies may decline, however gold often retains its worth.

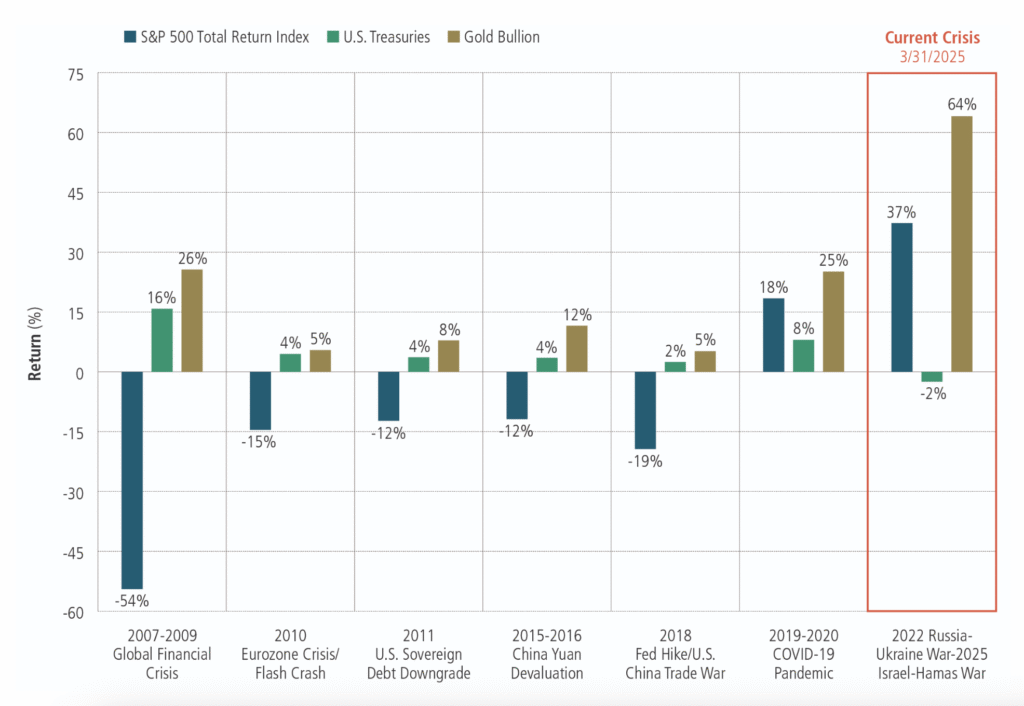

- Portfolio Diversification: Together with gold in a retirement portfolio may help mitigate risks associated with market volatility. Valuable metals usually have a low correlation with traditional belongings, providing a buffer during financial downturns.

- Tangible Asset: In contrast to stocks or bonds, gold is a bodily asset that buyers can hold. This tangibility can present peace of mind, especially throughout instances of financial uncertainty.

- Tax Advantages: Gold IRAs enjoy the same tax advantages as conventional IRAs. Contributions could also be tax-deductible, and the growth of investments is tax-deferred till withdrawal throughout retirement.

Concerns Before Investing

Whereas Gold IRAs offer numerous advantages, there are additionally essential considerations to bear in mind:

- Charges and Bills: Buyers ought to be aware of the fees associated with establishing and maintaining a Gold IRA. These may embody custodian charges, storage fees, and transaction fees, which might range significantly between providers.

- Market Volatility: Although gold is commonly seen as a safe haven, its value can nonetheless be subject to fluctuations. Investors should be ready for market volatility and have an extended-time period investment horizon.

- Regulatory Compliance: As with all retirement account, compliance with IRS rules is essential. Traders must make sure that their Gold IRA meets all necessities to keep away from penalties.

- Restricted Liquidity: While gold may be offered comparatively simply, it is probably not as liquid as different investment choices like stocks or bonds. Traders ought to consider their liquidity wants when investing in a Gold IRA.

Steps to Get Started with a Gold IRA Kit

For those fascinated by establishing a Gold IRA, the following steps can guide the process:

- Research and select a Custodian: Start by researching respected custodians that specialize in Gold IRAs. Look for reviews, fees, and providers provided.

- Open a Gold IRA Account: As soon as a custodian is selected, the following step is to open a Gold IRA account. This usually involves finishing an application and reliable investment options with gold providing mandatory documentation.

- Fund the Account: Buyers can fund their Gold IRA through a rollover from an existing retirement account or by making a direct contribution. Make sure that the switch adheres to IRS regulations.

- Choose Your Precious Metals: After funding the account, buyers can select the sorts of precious metals they wish to purchase. Work with the custodian to ensure compliance with IRS pointers.

- Safe Storage: Arrange for the secure storage of the purchased metals via the custodian’s advisable depository. This ensures that the property are saved in compliance with IRS rules.

- Monitor and Handle Investments: Commonly overview the efficiency of the Gold IRA and make changes as obligatory. Stay knowledgeable about market traits and financial indicators that may influence the worth of treasured metals.

Conclusion

A Gold IRA kit can be a priceless device for investors seeking to diversify their retirement portfolios and safeguard their savings towards economic uncertainties. By understanding the parts of a Gold IRA, the advantages it provides, and the considerations to remember, individuals could make informed choices about incorporating treasured metals into their retirement technique. As with all funding, thorough analysis and cautious planning are important to reaching long-time period monetary targets.

댓글목록

등록된 댓글이 없습니다.