Most People Will never Be Great At Gold Price Chart. Read Why

페이지 정보

작성자 Tamera Steffan 작성일24-12-05 02:51 조회10회 댓글0건관련링크

본문

When thinking in regards to the phrases gold market, typically folks associate them to buying bullion or certain jewellery items. Others select to speculate on the planet of gold stocks, watching the market closely, buying and promoting when appropriate to make an incremental improve in income over a long time frame. Have you ever ever thought of selling your unwanted gold pieces or seen a business on television from a 3rd occasion offering to buy your old gold at spectacular prices? What chances are you'll not have known is that gold is needed in different industrial areas like aerospace engineering, the medical business and also electronic devises. For those who've invested in gold up to now decade, holding the steel for over three years, it is 'previous dependable' and compos.ev.q.pi should have garnered individuals a stable return on their holdings. Investors have extensively used gold to their advantage, ensuring that it's part of their portfolios, thus growing diversity in investments, hedging themselves from potential market dangers.

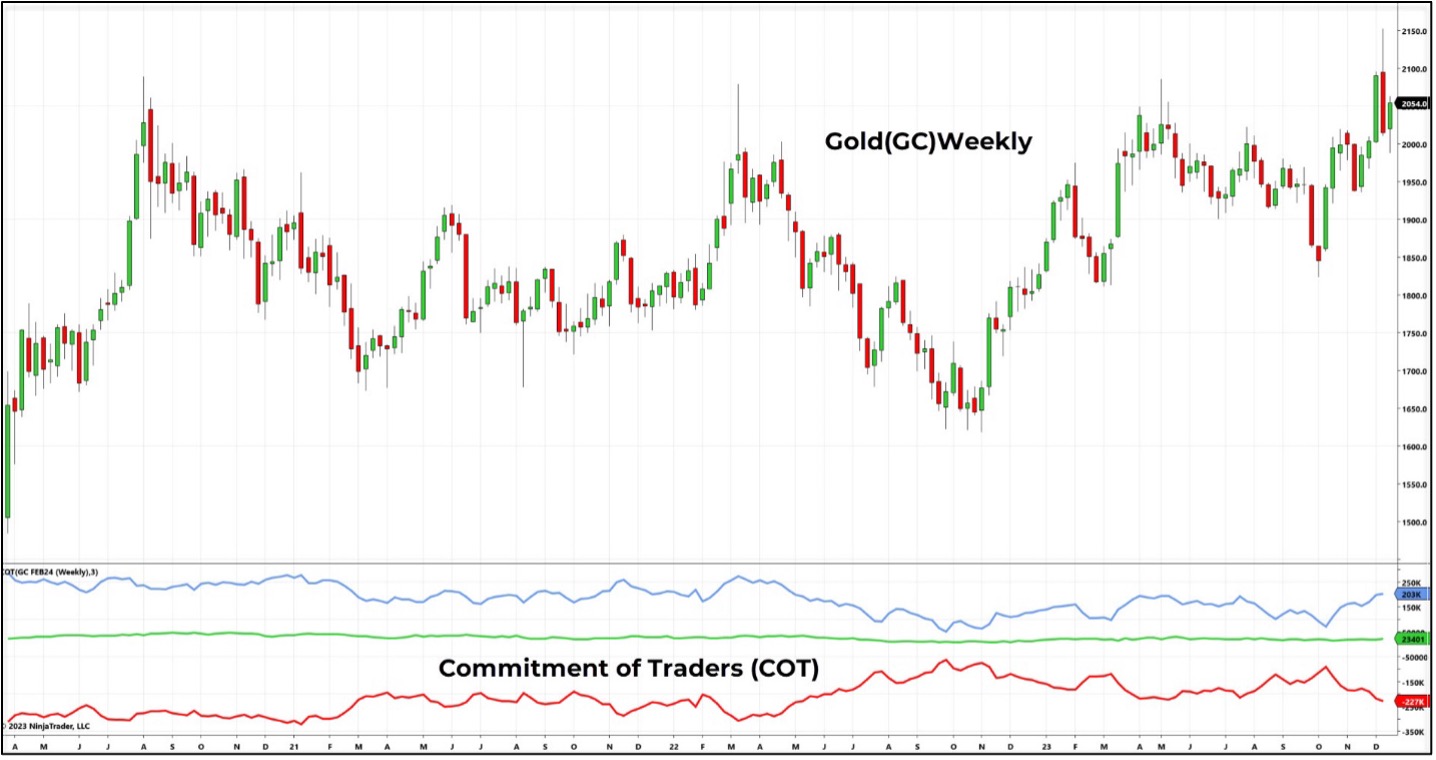

By making good investments, like with American Express, he grew his internet value from hundreds to thousands and thousands to what it is at the moment -- 80.3 BILLION dollars! As economies battle with dampening financial conditions, coping with chaos and greed on the inventory alternate, and the notable lack of safety in widespread, daily, traditional investments, individuals and buyers, alike are learning to plan their investment strategies, taking every step with warning and heed. The Housing Bubble Crisis, further intensified by a pointy enhance in international commodity prices, left most economies in a significant recession. A Current Spot Price is calculated as a bid/ask average, based mostly on a digital non-stop worth discovery strategy of active comparable commodity transactions. Spot costs for gold are consistently changing, as can be seen on any gold (sites.google.com) price chart. As gold prices soar to new heights, gold returns have been gratifying over the past decade; the numbers only seem to get higher.

By making good investments, like with American Express, he grew his internet value from hundreds to thousands and thousands to what it is at the moment -- 80.3 BILLION dollars! As economies battle with dampening financial conditions, coping with chaos and greed on the inventory alternate, and the notable lack of safety in widespread, daily, traditional investments, individuals and buyers, alike are learning to plan their investment strategies, taking every step with warning and heed. The Housing Bubble Crisis, further intensified by a pointy enhance in international commodity prices, left most economies in a significant recession. A Current Spot Price is calculated as a bid/ask average, based mostly on a digital non-stop worth discovery strategy of active comparable commodity transactions. Spot costs for gold are consistently changing, as can be seen on any gold (sites.google.com) price chart. As gold prices soar to new heights, gold returns have been gratifying over the past decade; the numbers only seem to get higher.

That time, those financial advisers might have been thought to be prophets of doom however with the downfall of greenback, to invest on gold was the most effective answer folks may turn to. As investors turn to real protected property to safe their monetary stability, gold remains a chief possibility. As the global financial system battles the effects of the coronavirus and nations come to phrases with the adverse impacts of the pandemic, people slowly lose trust in the nations' governments, financial techniques, and so-known as 'safe' property. The uncertainty of the global pandemic and its widespread results on the worldwide financial system have left governments and people alike, in a state of confusion and panic. Like other paper assets, market fluctuations and inflation have affected the US dollar's worth; however gold has remained the most effective tangible asset with no negative impact on its intrinsic worth. Higher worth of gasoline has result in additional inflation and increases in the value of precious metals. These bonds return after inflation are detrimental since the interest charges are so low. GDP ranges noticed huge drops throughout the globe as economies started to shrink, world oil consumption fell, unemployment charges soared, the UK jobless charge reached a ten-12 months excessive of 7.6%, and the financial recession was in full swing.

Banks across the globe, together with the US Federal Reserve, cut curiosity charges drastically and run on banks, elevated considerably. The height of the disaster was arguably reached in September 2008 when Lehman Brothers filed for bankruptcy, followed by various other banks and monetary institutions, just like the Swiss Bank and the funding bank Merrill Lynch, asserting the losses they made investing in sub-prime associated investments. Gold costs have reached $1853.14 as of this writing and in spite of what the President Obama claims, this is a sign that the traders aren't having a cool time with their trust within the stocks, bonds and other currencies. That’s not to argue that the world has reached "peak gold," (output might expand in future for quite a lot of causes). In this commotion and confusion, as you worry the effects of yet another recession and financial frenzy and look for a save asset, you'll be able to unthinkingly invest in gold and save gold in your future wants and economic and financial stability. A way of concern and insecurity looms over the investments market as individuals start to appreciate that their savings may disappear overnight in a financial system meltdown.

댓글목록

등록된 댓글이 없습니다.