Case Study: The Rise of Personal Loans On-line with Instant Approval A…

페이지 정보

작성자 Carmella Holroy… 작성일25-08-26 02:29 조회2회 댓글0건관련링크

본문

Introduction

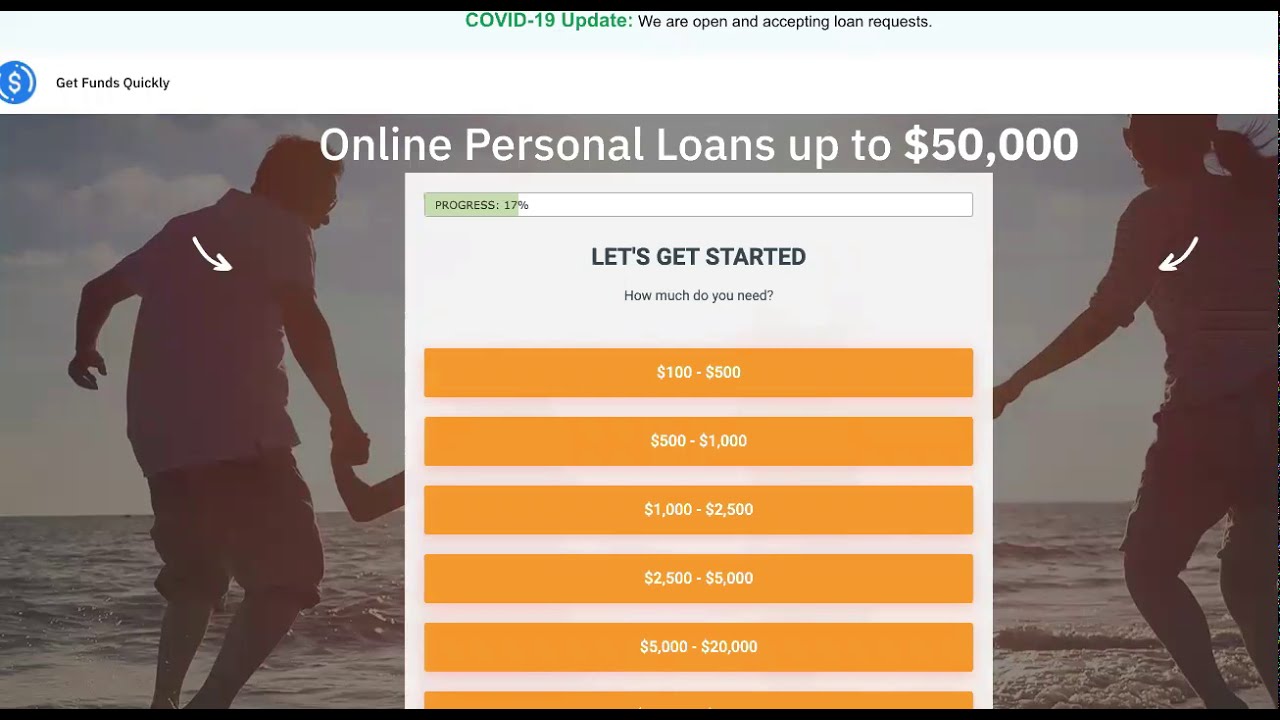

In recent times, the financial landscape has undergone a significant transformation, notably in the realm of personal loans. The arrival of technology has facilitated the rise of on-line lending platforms that offer instant approval for personal loans without requiring a credit score check. This case research explores the implications of this pattern, analyzing its attraction to shoppers, the operational mechanics behind these loans, and the potential risks involved.

The Appeal of Instant Approval Personal Loans

1. Accessibility

One of the primary causes for the recognition of online personal loans with instant approval and no credit check is their accessibility. Traditional banking establishments usually impose stringent necessities for loan approval, including an intensive credit score history review. This course of might be cumbersome and time-consuming, deterring many potential borrowers. In distinction, on-line lenders have streamlined the applying process, permitting people to use for loans from the consolation of their properties within minutes.

2. Pace

In today’s fast-paced world, the need for quick monetary options has never been higher. On-line personal loans with instant approval cater to this demand by offering funds nearly immediately after the appliance is submitted. Borrowers can obtain approval inside minutes, and funds might be deposited into their accounts inside a day. This immediacy is particularly attractive to those going through emergencies or unexpected expenses.

3. No Credit Check

For a lot of individuals, especially those with poor credit histories, the prospect of obtaining a loan will be daunting. Conventional lenders usually reject applications primarily based on credit score scores, leaving many without viable choices. On-line lenders that provide no credit check loans provide an alternate for these people, enabling them to entry funds with out the worry of rejection primarily based on their credit history.

The Mechanics of On-line Personal Loans

1. Application Process

The application process for online personal loans is usually straightforward. Borrowers fill out a digital form, offering fundamental personal information, earnings particulars, and the quantity they want to borrow. In contrast to conventional lenders, online platforms often utilize different information sources to assess a borrower’s creditworthiness. This will include earnings verification, employment history, and even social media activity.

2. Approval Algorithms

As soon as the appliance is submitted, lenders employ algorithms to evaluate the borrower’s data. These algorithms analyze the offered knowledge to determine the probability of repayment, permitting for instant approval decisions. This modern method enables lenders to evaluate risk with out relying solely on credit scores.

3. Loan Disbursement

Upon approval, funds are sometimes disbursed quickly. Most on-line lenders can switch cash directly to the borrower’s checking account inside 24 hours. This quick turnaround time is a significant advantage for borrowers who need fast access to funds.

The Risks Concerned

While the comfort of online personal loans with instant approval and no credit check is interesting, there are inherent risks that borrowers should remember of.

1. Excessive-Curiosity Charges

One of many most significant drawbacks of these loans is the potential for top-curiosity charges. Lenders offering no credit check loans usually charge greater rates to compensate for the increased danger they assume by lending to people with limited credit score histories. Borrowers could discover themselves in a cycle of debt if they're unable to repay the loan on time.

2. Predatory Lending Practices

The rise of on-line lending has additionally led to concerns about predatory lending practices. Some lenders could target susceptible people, offering loans with unfavorable phrases and hidden charges. It's crucial for borrowers to conduct thorough research and loans no credit check bad credit skim the high quality print earlier than committing to any loan agreement.

3. Impact on Monetary Well being

Taking on debt with out a complete understanding of repayment phrases can have long-term implications for a borrower’s financial health. Individuals who depend on these loans might discover themselves in precarious monetary conditions if they are unable to fulfill repayment deadlines, leading to additional fees and potential damage to their credit score scores.

Case Examine: A Borrower’s Expertise

As an instance the impression of online personal loans with instant approval and no credit check, we study the case of Sarah, a 28-yr-previous single mother facing unexpected medical bills.

Background

Sarah had lately lost her job and was struggling to make ends meet. If you adored this article therefore you would like to obtain more info regarding loans no credit check bad credit (visit the up coming internet site) please visit our internet site. When her daughter fell unwell and required pressing medical consideration, Sarah found herself in a monetary bind. With limited savings and no access to conventional credit resulting from a poor credit historical past, she turned to a web-based lending platform that offered personal loans with instant approval and no credit check.

The application Process

Sarah completed the web application in underneath 10 minutes. She provided her primary data and particulars about her revenue from freelance work. Inside minutes, she obtained an approval notification for a loan amount of $3,000 at an interest rate of 25%.

The decision

Confronted with the urgency of her scenario, Sarah accepted the loan regardless of the high-curiosity charge. The funds were deposited into her account the following day, permitting her to pay for her daughter’s medical remedy.

The Aftermath

While Sarah was ready to deal with her rapid monetary need, the high-interest rate posed a challenge. Over the next few months, she struggled to make payments, leading to extra fees and stress. In the end, Sarah learned the significance of understanding loan phrases and the potential consequences of taking on excessive-curiosity debt.

Conclusion

The rise of online personal loans with instant approval and no credit check has revolutionized the lending panorama, offering fast and accessible financial options to many individuals. However, it is important for borrowers to strategy these loans with warning. Understanding the dangers, conducting thorough analysis, and being conscious of one’s financial state of affairs is essential to making informed selections. As the net lending business continues to evolve, striking a steadiness between accessibility and accountable lending practices might be important in defending shoppers and ensuring their monetary well-being.

댓글목록

등록된 댓글이 없습니다.